Please click here to access the main AHDB website and other sectors.

- Home

- Knowledge library

- Natural Gas Market

Natural Gas Market

Previous GrowSave technical updates have focused on the electricity market when discussing the extreme energy market condition over the last couple of years, with minor mention given to the gas prices. Here, the gas market will be discussed in more detail.

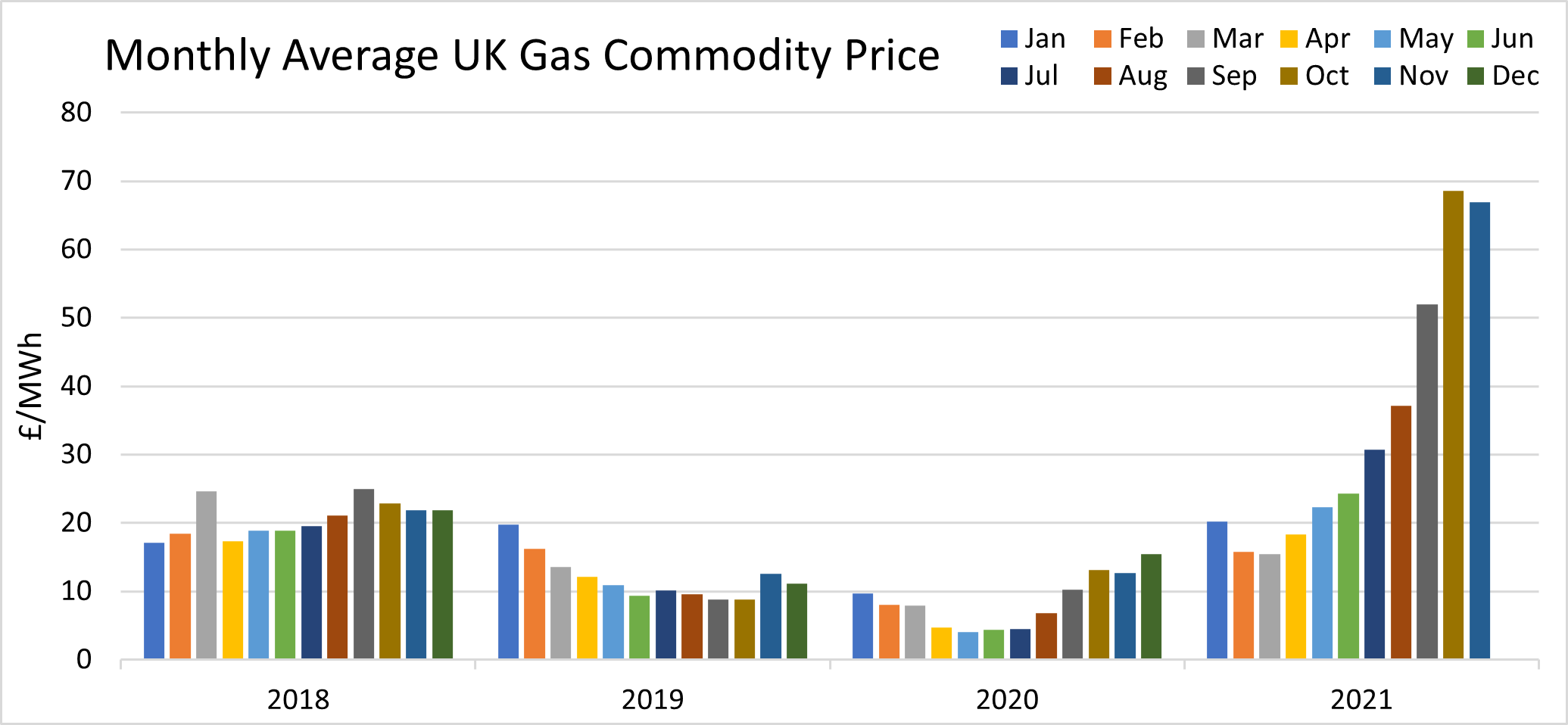

Similar to the electricity market, natural gas has historically had a seasonal swing in prices, following the increased demand over winter months and decreased demand during summer. However, 2020 and 2021 prices have been particularly extreme, seeing day-ahead gas prices range from around £3/MWh in April 2020 to £93/MWh in October 2021. Those prices are certainly exceptional; however, around 30-40% of UK electricity is generated using natural gas, and future increases to the country’s electricity demand paired with a greater reliance on inconsistent renewables will continue to be a source of instability in the gas market.

NFU energy

NFU energy

Purchasing

As well as having different options in the timescales at which a business can contractually purchase natural gas, it can also be bought in different states. The most common of which being as a gas from the UK grid, or as tankers/bottles of LNG (Liquefied Natural Gas). Trading on the future markets allows a business to set a tariff for a period anywhere from day-ahead up to 5 years ahead of consumption, while the spot market is used to purchase immediately delivered gas.

Different purchasing strategies represent varying levels of stability and risk, and greater levels of risk can have greater potential for profit for businesses willing to take that risk. Particularly, operators can benefit greatly from having diversity in energy generation, and therefore flexibility in their use of natural gas. Depending on your contracts and current gas tariffs, it could be financially preferable to run a backup generator which uses diesel or kerosene during days where gas price peaks.

Supply & Demand

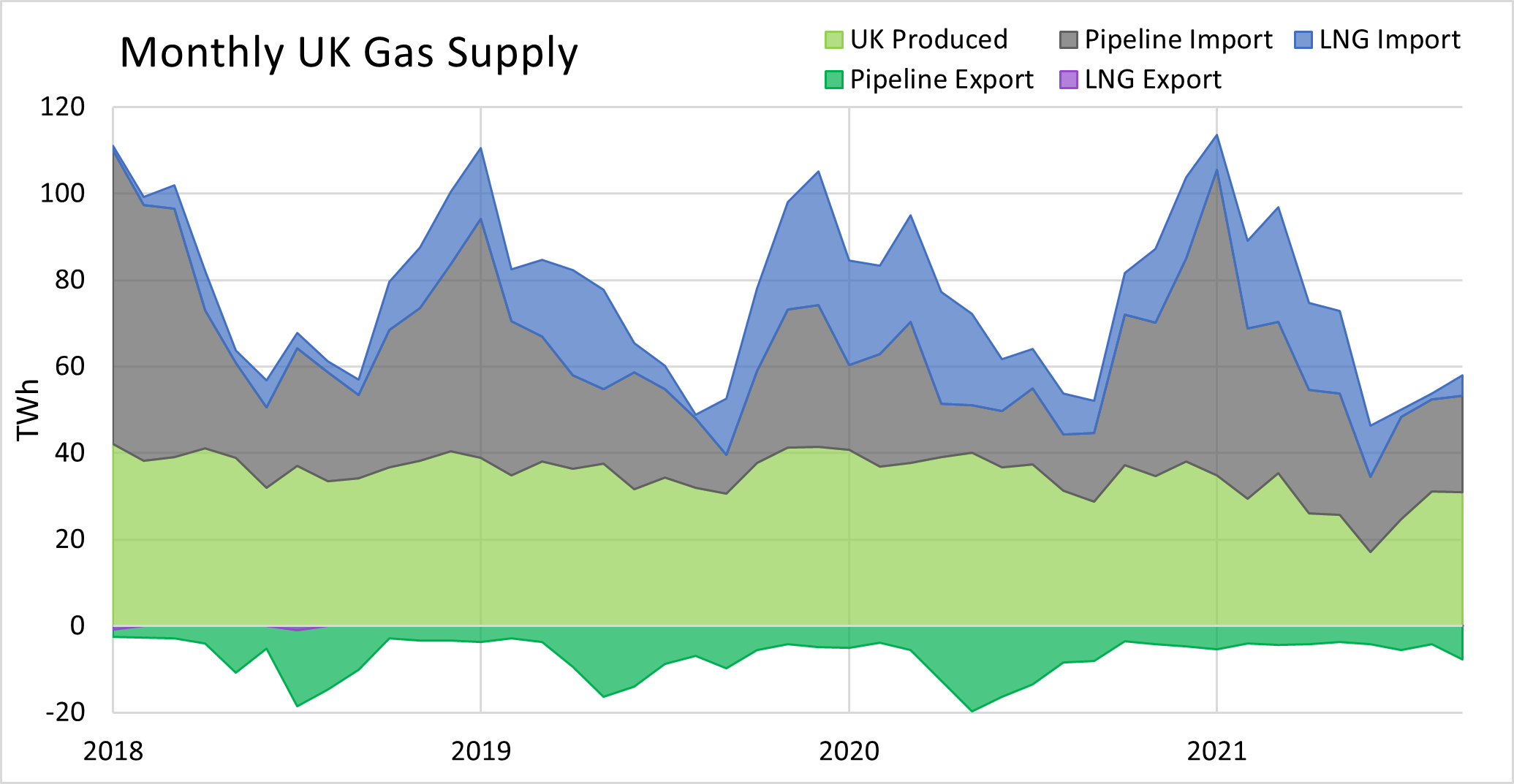

Natural gas is imported and exported by the UK via both physical pipelines and using LNG tankers. Typically, LNG comprises between 15-45% of the total gas import, and negligible amounts of the gas export. UK own production is around 47% of total UK gas supply.

Throughout the first half of 2020 there was a glut in gas supply, driven by a lull in demand caused by the national lockdown. It was expected that there would be a bounce-back in demand once lockdown had receded, but unfortunately, the rate and volume was not anticipated. Thus, towards the end of 2020 and throughout 2021, European stores of gas decreased beyond expected levels and supply to the UK has been tight.

As well, the Asian LNG demand proved resilient in its continued growth throughout 2020 and 2021, with willingness to pay higher prices than previously seen. This has again led to a tightness in the LNG supply to the UK.

Together, these factors have led to a decrease in the supply capacity of natural gas in the UK, and ultimately caused commodity prices to rise to compensate. Additionally, UK gas export in 2021 has been much lower than previous years, again signalling the lack of excess capacity. Figure 1 shows the UK gas production, import, and export volumes, highlighting the early 2020 lull and 2021 highs.

Figure 1 (Sources: National Statistics Energy Trends)

In the short to medium term, it is expected that heat production using electricity and electric vehicle usage will increase significantly. This extra burden on the electricity grid will have its own challenges, and while this change may reduce the amount of gas combusted at the point of use, between 35-40% of UK electricity is currently generated using natural gas. An increase to the electricity demand paired with a greater proportion of electricity produced by variable and weather-dependent renewable installations will lead to a heavier reliance on natural gas for generation. Some reductions in overall gas usage may be realised with increased energy use efficiency.

Although there has been an increase in biomethane production, fueled by various incentive schemes, it still represents only around 1% of the total UK gas supply. Future grid injection schemes and an increase in the use of gas as a road fuel will likely increase this amount, but a large change is required before biomethane becomes a significant portion of UK gas use. The current state of UK gas supply has a high sensitivity to international markets, and therefore a low security. A key part to combatting this sensitivity is increasing UK produced methane, and biomethane production is essential to that aim. Hydrogen may also play an important future role, but while some proof-of-concept installations are being tested, it is likely quite far away from commercially feasible rollout.

NFU energy

NFU energy

Figure 1 (Sources: National Statistics Energy Trends)

Pricing

Gas commodity price in general follows the balance between availability of supply and demand. The impacts of the events discussed above on the gas commodity prices led to the trends shown in Figure 2. Particularly concerning is the near-exponential growth starting in mid-2020, dwarfing all prices in recent memory by August 2021. However, November 2021 has broken that trend with a marginal decrease in average gas price.

Figre 2: (Source: Marex Spectron)

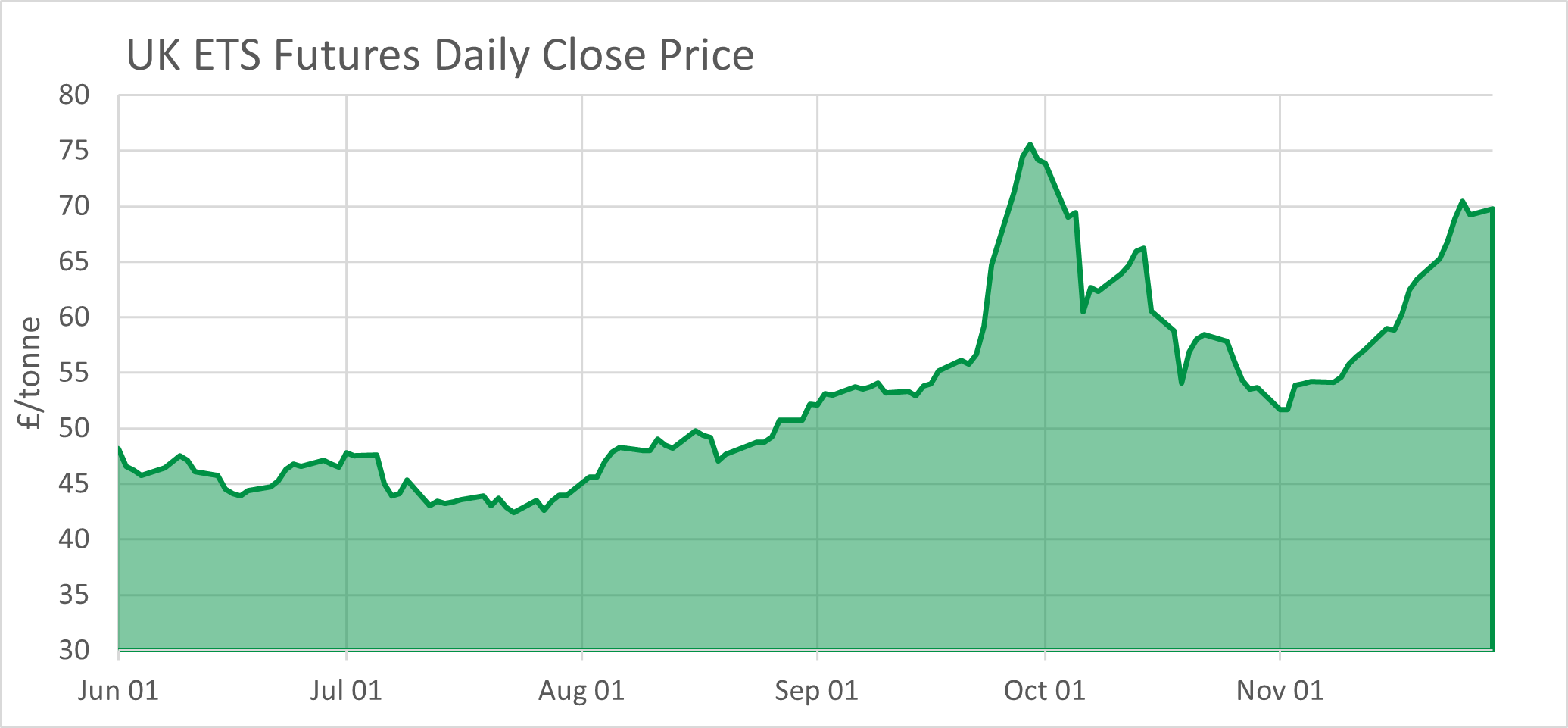

On top of the increase in commodity prices, non-commodity natural gas costs are expected to have additional pressure as UK Net Zero guidance and legislation is put into place. One example of this starting to occur is the UK ETS, which has seen considerable volatility in price since August 2021. The UK ETS Futures Daily Close auction prices from 01th June 2021 to 30th November 2021 are outlined in Figure 3.

NFU energy

NFU energy

Figre 2: (Source: Marex Spectron)

UK Emissions Trading Scheme is mandatory for large energy users (20MW+ thermal input), power generation, and aviation, whereby carbon equivalent emissions are traded by auction. Replacing the UK’s participation in the similar EU ETS as of 01st January 2021, with auctions beginning 19th May 2021.

NFU energy

NFU energy

Figure 3: (Sources: Ember Climate & ICE [Intercontinental Exchange])

Looking to the Future

The last 2 years have certainly been exceptional; however, changes to the way we consume electricity, as well as weather sensitivity caused by increasing renewable generation, will remain for the long term. This alone is enough to give steam to UK natural gas consumption.

While electrification of heat may change the way that natural gas is used, often these systems are not like-for-like replacements and can be unsuitable for many systems. Likewise, the uptake of electric or methane vehicles requires a large infrastructure change to be effective and may not be suitable replacements in many cases.

As well, while European and UK gas stores will likely recover, international LNG competition from Asia is unlikely to abate, keeping some price pressure on gas commodity costs. Likewise, as we draw closer to the UK Net Zero deadlines, increased pressures will likely be placed on fossil fuels. Altogether, we expect that gas prices will settle to a higher position than they were prior to the 2020 lockdown.

Future biomethane and hydrogen developments may reduce the UKs reliance on natural gas, but it is likely going to be a long time before those combined can make a significant impact on total supply.

With this in mind, consumers could benefit from diversifying their generation equipment. Simple calculations can be done to determine what the relative prices of gas and diesel/kerosene need to be before preferentially running a backup generator is worthwhile. While heat pumps are difficult to justify without an incentive scheme to mitigate their high capital costs, a new scheme or grant could make them a very attractive alternative. As well, biomass systems may be a viable option, particularly if high-carbon fuels begin to be penalised more heavily.

If carbon dosing is essential to your business, alternative streams of liquid CO2, such as biogas upgrading plants, could be investigated to help reduce your reliance on natural gas combustion.

Topics:

Sectors:

Tags: